Feeling the squeeze when paychecks arrive is common. You may have watched family plan rates climb and felt a mix of worry and determination. The Kaiser Family Foundation shows steep rises: many families now face thousands more each year.

You don’t have to choose between budget and quality. This section offers a clear, step-by-step way that helps protect the benefits you value while finding real savings. You will learn practical moves, like comparing carriers, weighing HDHPs with HSAs, and using telehealth.

By setting a simple budget, defining medical needs, and targeting plan features that matter, you can lower costs without sacrificing essential protection. Read on for a calm, practical approach that leaves you with a personal action plan and steady savings.

Key Takeaways

- Use clear budgeting to match a plan with your actual needs.

- Compare carriers and plan details, not just sticker price.

- Consider HDHPs paired with HSAs for tax-smart savings.

- Apply telehealth and preventive care to reduce year-round costs.

- Focus spending on benefits that preserve long-term quality and access.

Why premiums are rising and what that means for your budget today

Over the past decade, bigger bills and plan changes have steadily moved more medical spending onto members. You now face higher health insurance premiums and sharper trade-offs at renewal.

KFF data shows family premiums rose about 20% over five years and 43% over ten. In 2022, combined employer and employee spending averaged $7,911 for an individual plan and $22,463 for a family plan.

Key trends from KFF on employer and individual plan costs

Premiums keep climbing while wages lag. Plans shift more charges to members through higher deductibles, copays, and coinsurance. That means the sticker price is only part of your actual cost.

How rising premiums impact your out-of-pocket expenses

Preventive screenings and many preventive services remain covered with no cost sharing. But non-preventive visits, brand drugs, specialist imaging, and prior authorization changes can raise household expenses quickly.

- Plan design matters: premium, deductible, coinsurance, and out-of-pocket maximum all shape real spending.

- Networks and rules: narrower networks or stricter approvals can change where you get care and how much you pay.

- Group vs. individual: market pressures affect each differently at renewal, so compare yearly.

| Metric | Typical 2022 Value | Member Impact | Action |

|---|---|---|---|

| Average individual spend | $7,911 | Higher monthly outflow | Check deductible vs premiums |

| Average family spend | $22,463 | Strains household savings | Evaluate plan tiers and networks |

| Family premium change (10 yrs) | +43% | Long-term budget pressure | Benchmark against KFF trends |

How to Cut Your Monthly Premiums Without Losing Coverage

Start with a clear, personal inventory of care you actually use. Catalog routine visits, prescriptions, and any specialists. That list is the baseline for comparing plans and protecting quality.

Define your healthcare needs and risk tolerance first

Match real needs to benefits. Write down yearly visits, chronic meds, and upcoming procedures. Note any labs or imaging you expect.

Map providers and pharmacies so you confirm network and formulary alignment before you switch. This preserves continuity and avoids surprise bills.

Set a monthly budget and a maximum out-of-pocket threshold

Set a budget anchored to a worst-case scenario: deductible plus coinsurance up to the out-of-pocket max. That shows true annual exposure, not just sticker price.

- Compare a lower premium with higher out-of-pocket and a higher premium with lower pocket risk.

- Organize planned procedures and preventive visits within a single plan year when possible.

- Create a shortlist of plans and stress-test each against a realistic care scenario.

| Item | What you record | Action |

|---|---|---|

| Routine visits | Number and specialist type | Check copays and network |

| Medications | Tier and pharmacy | Verify formulary and cost |

| Worst-case cost | Deductible + coinsurance | Set monthly buffer in your budget |

Document your assumptions so you can compare plans year over year and choose the option that balances premiums, pocket exposure, and long-term health priorities.

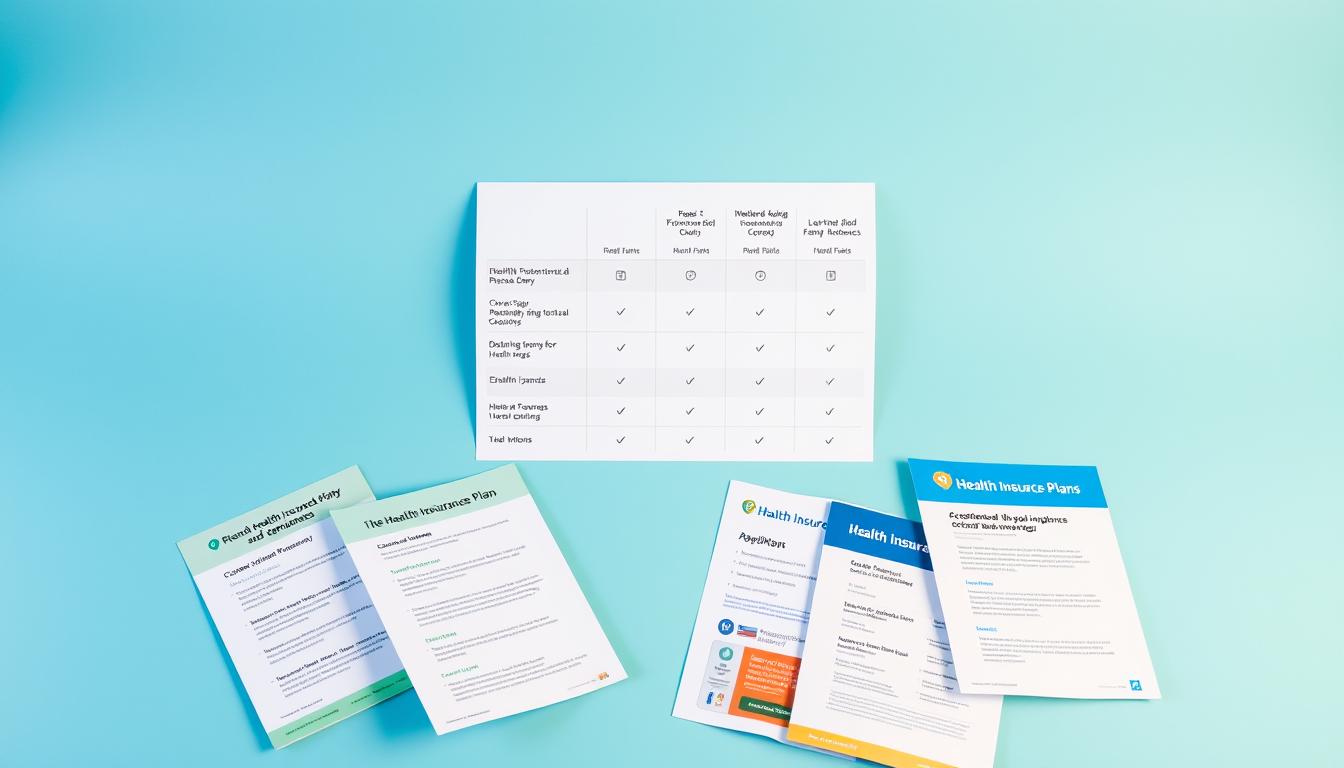

Compare plans the right way to lower total costs, not just premiums

Comparing plans requires a simple math check: premiums plus likely claims for your care. Start by modeling expected visits, prescriptions, and any scheduled procedures. That gives a true view of annual insurance costs.

Balance premiums, deductibles, copays, and coinsurance

Don’t chase lowest monthly price alone. Compare a lower premium with a higher deductible and coinsurance against a richer plan. Small coinsurance differences add up when you need repeated services.

Check formularies and prior authorization rules for prescriptions

Verify that drugs you use are on each plan’s formulary. Note any step therapy or prior authorization that could delay access or raise out-of-pocket costs.

Evaluate provider networks to avoid surprise out-of-network bills

Confirm your primary care, specialists, hospitals, and labs are in-network. Group networks and individual plans can differ, and balance billing is common when a facility or provider is out-of-network.

| Factor | What you check | Why it matters |

|---|---|---|

| Premium + expected claims | Model yearly costs | Shows true annual expenses |

| Formulary rules | Drug tier, prior auth, step therapy | Affects medication access and costs |

| Network breadth | Provider and facility lists | Prevents surprise out-of-network bills |

| Plan benefits | Telehealth, urgent care, mental health | Alters convenience and routine costs |

Use high-deductible plans strategically with an HSA

Choosing the right pairing means balancing near-term exposure with long-term savings. An HDHP typically offers lower monthly premiums but higher deductibles. That trade-off can work well if you expect light health use this year.

- Gauge whether a higher deductible HDHP lowers monthly costs enough to justify more early-year cash exposure.

- If you need frequent visits or major procedures, a richer plan may save money over the full year despite higher premiums.

- Check employer HSA contributions—employer funds can tilt the math toward the HDHP option.

Tax advantages of an HSA and qualified medical expenses

- A health savings account offers a clear tax advantage: contributions are pre-tax, growth is tax-free, and withdrawals for qualified medical expenses stay tax-free.

- Use HSA funds for prescriptions, imaging, and many office visits to smooth costs and protect savings.

- Automate contributions and remember HSA ownership is portable; the account follows you across jobs.

Unlock Marketplace savings with subsidies and cost-sharing reductions

Subsidies and cost-sharing reductions change the math on which plan saves you most over a year. Marketplace premium tax credits reduce what you pay each month based on your household income and the benchmark plan.

How premium tax credits work based on income

Premium tax credits lower monthly premiums when you enroll through the Marketplace. The credit size follows your income and household size and applies against the benchmark plan.

Report midyear income changes so your subsidy stays accurate and you avoid repayment surprises at tax time.

Why Silver plans matter for cost-sharing reductions

Cost-sharing reductions (CSRs) are available only on Silver-tier insurance plans. CSRs cut deductibles, copays, and out-of-pocket maximums for eligible enrollees.

Choosing a Silver plan with CSRs often lowers total costs without sacrificing access to routine services and essential care.

- Compare net premium plus expected annual spending for Bronze versus CSR-enhanced Silver.

- Gather proof of income and household size for faster eligibility verification.

- Coordinate subsidies with HSA decisions if you consider an HDHP.

| Feature | Bronze | CSR Silver | When it helps |

|---|---|---|---|

| Monthly premium | Lower | Moderate after credit | Low use year vs. moderate use |

| Deductible & copays | High | Lower with CSR | Frequent visits or meds |

| Out-of-pocket max | Higher | Reduced | Protects against big bills |

Leverage employer, group, and association options for better rates

Group purchasing power often brings measurable savings. Many employers negotiate lower rates and add contributions that lower your out-of-pocket costs. Associations, unions, and alumni groups sometimes offer similar access or discounts that can better your alternatives on the individual market.

Comparing employer-sponsored coverage with individual plans

Weigh contributions and stability. Employer plans often include employer-paid premiums, HSA matches, HRAs, or wellness perks that shrink your real monthly costs. Compare net premium plus expected claims rather than sticker price alone.

Association, union, and alumni group opportunities

Group-style arrangements through unions or alumni networks can widen provider networks and deliver lower insurance premiums. Check eligibility, enrollment windows, and portability if you expect job changes.

| Option | Typical advantage | What you check |

|---|---|---|

| Employer group | Employer contribution, negotiated rates | Premium split, HSA/HRA offers, network |

| Union/association | Group pricing, broader networks | Membership rules, enrollment periods |

| Individual market | Flexible choice, portability | Formulary, deductibles, total costs |

- Consider dependent contributions and whether mixing employer and individual coverage lowers costs.

- Review ancillary benefits like mental health and disease management that reduce long-term costs.

- Check COBRA rules and enrollment windows to avoid lapses in coverage.

Consider HRAs and stipends to control costs without sacrificing coverage

Offering targeted reimbursements helps align company budgets with the health needs of staff without locking everyone into one plan.

What HRAs do: Employer-funded HRAs are not subject to annual premium hikes and can reimburse eligible medical expenses or premiums tax-free when employees have minimum essential coverage.

QSEHRA, ICHRA, and GCHRA explained

- QSEHRA: for employers with fewer than 50 full-time equivalents; reimburses documented health expenses.

- ICHRA: works at any employer size and can reimburse individual premiums, giving employees plan choice and provider freedom.

- GCHRA: pairs with a group plan to offset deductibles, copays, and coinsurance, lowering out-of-pocket costs.

When a taxable health stipend can be a better fit

Stipends are simple and flexible, but they are taxable and do not meet ACA employer mandate rules. They may suit teams where many employees qualify for Marketplace subsidies.

| Option | Tax treatment | Best when |

|---|---|---|

| HRA | Tax-free with MEC | Control employer costs without premium spikes |

| Stipend | Taxable | Simplicity and subsidy-heavy workforce |

| GCHRA | Tax-free with MEC | Supplement existing group plan expenses |

Next steps: Map your budget, set allowances, and pick an administration method—self-managed or third-party—to ensure compliance and clear documentation for reimbursements.

Trim extras you don’t need while protecting essential benefits

Small cuts in add-ons can free budget without hurting core protections.

Start with an item-by-item audit of your benefits. Look for duplicative riders like dental or vision that you already get through work or a standalone plan. Removing those can lower your premiums while keeping key coverage intact.

Move routine care into lower-cost settings when possible. Use retail clinics, telehealth, or in-network urgent care for minor issues. That reduces annual expenses and preserves funds for serious care.

- Review plan documents to avoid paying twice for the same service.

- Choose generics and ask pharmacists about lower-cost alternatives for common prescriptions.

- Check whether a narrower network still includes critical specialists and hospitals you need.

- Use member portals and price tools before scheduling labs, imaging, or vaccines.

Prioritize benefits that guard against catastrophic bills: hospitalization, surgeries, and chronic condition management. Coordinate FSA or HSA dollars for remaining costs and compile a simple keep-or-cut list focused on value per premium dollar.

| Feature | Action | Why it matters |

|---|---|---|

| Duplicate dental/vision | Drop if covered elsewhere | Lower premiums, same quality |

| Brand drugs | Switch to generics | Reduce medical expenses yearly |

| Narrow network | Confirm key providers in | Lower cost without losing access |

Take advantage of preventive care to avoid bigger medical expenses

Regular checkups and early screenings catch small problems before they become costly emergencies.

Adult screenings you can schedule now: blood pressure, cholesterol checks, diet counseling, and routine immunizations. These visits are commonly covered with no charge under many plans.

Women’s and children’s services to use this year

Women’s services include mammography, Pap tests, birth control counseling, breastfeeding support, and well-woman visits.

Children’s services include well-child visits, immunizations, developmental screenings, behavioral checks, and vision tests.

| Service | Typical benefit | Why it matters |

|---|---|---|

| Adult screenings | No-cost preventive visit | Detects risks early, reduces long-term costs |

| Women’s services | Covered screenings & support | Improves outcomes and lowers future claims |

| Children’s visits | Routine exams & immunizations | Early care speeds recovery and saves money |

Confirm coverage details before you book. Use your insurer’s wellness portal for scheduling and incentives. Employers often promote these services because they reduce claims and provide clear benefits employees can use now.

Use telehealth and virtual care to reduce non-emergency costs

Virtual visits can be a practical way to manage minor illness and routine follow-ups. When you choose telehealth, you get faster triage, prescription renewals, and often lower fees than an urgent care or emergency trip.

When telemedicine can replace urgent care or ER visits

Use virtual care for colds, minor infections, rashes, medication refills, and basic screenings when symptoms are stable.

Avoid the ER for non-urgent issues; a Jefferson Health System study found avoiding emergency department visits saved between $309 and over $1,500 per episode.

Insurer incentives and employer savings from telehealth

Many plans waive or cut telehealth copays and offer preferred services that lower monthly costs. Employers push virtual visits to cut absenteeism and claims.

“Telemedicine often resolves minor conditions at a fraction of the out-of-pocket cost of urgent care or the ER.”

- Check your plan for waived copays and covered telehealth services.

- Set up accounts and confirm your provider is licensed in your state.

- Use a simple checklist (symptoms, meds, photos) to speed visits and improve outcomes.

| Scenario | Typical cost | When to pick |

|---|---|---|

| Virtual visit | $0–$50 | Minor illness, refills, triage |

| Urgent care | $75–$200 | Moderate injuries or fever |

| ER visit | $300–$1,500+ | Serious or life-threatening emergency |

Tip: Use telehealth for routine screenings and chronic monitoring when available. That advantage can deliver real savings while protecting your health and keeping overall insurance expenses lower.

Optimize family coverage choices to fit your household and budget

A careful look at who needs frequent care and who is low-use can change which enrollment setup saves your household the most.

Compare a full family plan versus separate enrollments. Model costs for each member, including prescriptions and specialist visits. That reveals which configuration lowers your pocket exposure while keeping key care intact.

Consider pairing employer group coverage for one adult with an individual plan for dependents. Some families save by staggering plan start dates around planned procedures or births.

Check pediatric networks and maternity rules before you switch. Verify coordination of benefits when both parents carry insurance so claims are not denied.

- Assess who may require frequent visits and who is low-use.

- Model out-of-pocket costs for each setup, including pharmacy tiers.

- Document a decision matrix and revisit it at open enrollment.

| Option | Advantage | When it helps |

|---|---|---|

| Family plan | Simpler billing, unified network | Similar use patterns |

| Mixed enrollment | Lower total costs, targeted benefits | Different member needs or employer offers |

| Staggered start dates | Aligns premiums with life events | Planned procedures or births |

Mark open enrollment and special enrollment periods to lock in savings

Open enrollment is the main window each year for switching coverage. Mark those dates now so you have time to compare plans and avoid rushed decisions. Applying early preserves choice and limits the chance your preferred network fills up.

Timing your application and changes for maximum benefit

Enroll early in the window to secure a better mix of premiums, networks, and deductibles. If you expect a planned procedure, align effective dates so costs fall in the same plan year.

Qualifying life events that let you switch plans midyear

Special Enrollment Periods open after life events like marriage, birth, a move, or loss of employer coverage. File documentation quickly—birth records, marriage certificates, or proof of address—to avoid delays.

- Check effective dates and request ID cards so care starts without a gap.

- Consider plan portability if you may relocate or change employers.

- Set calendar reminders for next year so you never miss the window again.

“Apply early and have documents ready; that prevents emergency coverage gaps and claim denials.”

Conclusion

Use timing, account options, and simple care choices as a clear way to keep insurance costs steady while protecting access to care.

Combine HDHPs with a health savings account, Marketplace Silver plans with CSRs, HRAs, preventive care, telehealth, and wellness programs so you can lower health spending and still get essential services. If you require frequent visits, weigh a higher deductible against employer contributions and health savings that cover expected expenses. This balanced approach helps benefits employees and households alike.

Review options at open enrollment or after life events. Trim extras that add cost but little value. With a steady plan and disciplined choices you can preserve care without sacrificing quality and protect long-term health and finances in both group and individual markets.